State Bank of India (SBI), a Fortune 500 entity, is an Indian Multinational, Public Sector Banking and Financial services statutory body headquartered in Mumbai. It has broadened its business activities through its diverse subsidiaries. The State Bank of India Group comprises State Bank of India, 26 Subsidiaries, 7 Joint Ventures, and 19 Associates. It has expanded globally and operates in different time zones with 241 offices in 29 foreign countries.

Awards and Recognition in FY2023-24:

- SBI received the Top Performing Bankaward under EASE 5.0 of PSBs Reforms Agenda.

- The Bank featured among the Top 25 Strongest Brands globally for 2024 – basis Brand Finance Annual Report on most valuable and Global Brands – Global 500 2024

- It was recognized as the Best Bank in India for the year 2023 by Global Finance Magazine at its 30th Annual Best Banks Awards event held at Marrakech, Morocco during the occasion of 2023 IMF/WB Annual Meetings held in October 2023.

- It was awarded the Company of the Year Award – 2023 by the ET Awards for Corporate Excellence 2023. It was adjudged the Most trusted BFSI Brands 2023-24 by the Economic Times Group.

- It received the Dunn & Bradstreet Award in the Category – PSU Banks over 4 Lakh Crore assets size at the PSU & Government Summit 2023.

- It also received the ICAI Awards for Excellence in Financial Reporting Award.

Products and Services:

The product and services of SBI can broadly be divided into following categories:

Personal Banking: SBI provides a comprehensive range of financial services, including various loan products, savings accounts, current accounts, salary packages, digital loan offerings, NRI business solutions, and wealth management services, among others.

Rural Banking: The Bank caters to the requirements of the rural population in India by offering financial inclusion, microcredit, and support for agricultural businesses.

International Banking Group: SBI leads the way in International Banking in India, continuously influencing the banking sector with our Overseas Branches, Overseas Banking Subsidiaries, Joint Ventures, and Associates.

SME Banking: The Bank is at the forefront of SME (Small and Medium Enterprise) financing, providing cutting-edge financial options to our SME customers.

Corporate Banking: The Corporate Accounts Group and Commercial Credit Group of SBI provide a wide variety of financial products and services to leading corporations in the country, including Navratna PSUs.

Government Business: The Bank continues to maintain its position as the unrivaled leader in Government business, making a substantial contribution to the advancement of e-governance initiatives by the Government of India. Additionally, it plays a pivotal role in the development of electronic solutions for both the Central and State Governments.

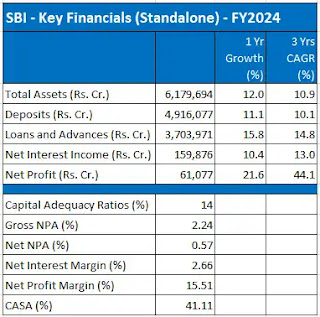

Key Financials (FY2024):

SBI, with an asset base exceeding Rs. 61 trillion, stands as India's foremost banking and financial services institution. Its extensive network of 22,783 branches, 63,580 ATMs/ADWMs, and 82,900 BC outlets caters to a staggering customer base of over 50 crore individuals.

At the conclusion of the fiscal year 2024, SBI's Total Assets amounted to Rs. 6,179,694 Cr, with Deposits at Rs 4,916,077 Cr and Loans and Advances at Rs 3,703,971 Cr. The Bank's Total Assets saw a 12% increase year-on-year and a 10.9% growth over 3 years on a CAGR basis. Deposits increased by 11% year-on-year and 10% over 3 years on a CAGR basis, while Loans & Advances grew by 15.8% year-on-year and 14.8% over 3 years on a CAGR basis.

The Net Interest Income (NII) of the Bank was recorded at Rs 159,876 Cr, with Net Profit at Rs. 61,077 Cr by the end of FY2024. NII experienced a 10.4% growth year-on-year and a 13% increase over 3 years on a CAGR basis, while Net profit rose by 21.6% year-on-year and 44.1% over 3 years on a CAGR basis.

The Capital Adequacy Ratio stood at 14%, surpassing the percentage mandated by the RBI. Gross and Net NPA were at 2.24% and 0.57% respectively. The Bank's Net Interest Margins were at 2.66%, with Net Profit Margin at 15.51%. The CASA ratio was at 41.11%, exceeding the industry average.

Future Plan:

SBI prioritizes preserving the environment and managing natural capital due to climate change risks and opportunities. Its customer-focused approach and commitment to improving the banking experience have made it the top bank in the country. SBI creates a supportive work environment, streamlines operations, and embraces digital transformation to boost productivity. It actively participates in initiatives for education, healthcare, sustainability, and community development. Governance is closely monitored by the Board of Directors. SBI plans to invest in IT infrastructure for safety and reliability and utilize analytics for business expansion and risk management.

Go to Index page

Data Source

- SBI's website

- SBI Annual Report 2023-24

Disclaimer

The content or analysis presented in the Blog is exclusively intended for educational purposes. It is important to note that this should not be considered as a suggestion for investing in stocks or as legal or medical advice. It is highly recommended to seek guidance from an expert before making any decision.

You would also like to read:

- SBI – Contribution in Financial Inclusion in India (2024)

- Punjab National Bank - Snapshot

- JIO, LIC, and SBI - Among the Top 25 Strongest Brands Globally

- Comparative Analysis of Business Segments of Top 3 Public Banks

- Non-performing Assets

- Capital Adequacy Ratio

- Comparison of Net Interest Margins of Top 6 Banks in India

- Sources of Funds of Banking Business

- Comparison of Assets of Top 6 Banks in India

- Analysis of Price-to-Book Ratio of Top 6 Banks in India

- Comparison of Shareholding Patterns of Top 6 Banks in India